The president and congress are about to lose their starring economic policy role with a repeat of the unforced errors committed in 2011when Mark Meadows’ Tea Party drove a sharp switch to austerity. The result was an 9-year journey back to full employment.

Congress, the president, and the Federal Reserve, along with healthcare providers, have so far been the heroes of the pandemic response. However, the failure to gain agreement for the next phase of economic support places the hoped-for recovery at even greater jeopardy than it already is. Lacking a vaccine and without an ability to stop the virus’s spread, consumer spending and income growth are at risk of turning negative.

In the months of March to June, when the pandemic as at its worst, government assistance programs replaced 98% of destroyed income that resulted from collapsing consumer spending, exploding precautionary saving, and disappearing jobs. Importantly, 80% of the assistance was provided by newly created programs – e.g., pandemic unemployment compensation payments, Paycheck Protection Program, and the economic impact payments to individuals.

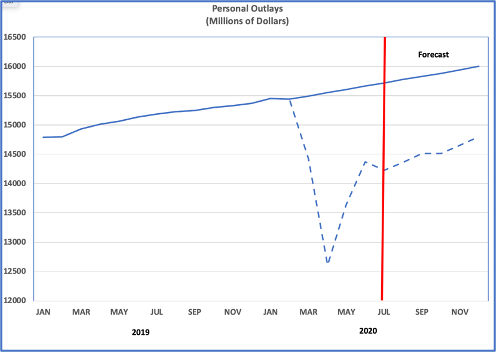

With 2020 wage and salary income having fallen 6% between February and June and with the savings rate having increased from 8% to 19%, personal outlays fell by 7%. The result was the skyrocketing of the unemployment rate to 14.7% in April.

Current consensus consumer spending forecasts for the balance of 2020 indicate an equally large hole to fill, even as growth recovers. After a 7% 1Q decline and a 35% 2Q decline, a 28% 3Q increase and a 6% 4Q increase will still leave consumer spending in 2H with just as large a hole to fill as in 1H.

Including the consensus forecast in the figure below, the area between the solid and the dashed lines can be thought of as the lost jobs and income from consumer spending falling substantially below its previous trend. With the unemployment rate at 10.2% and coronavirus raging, renewed austerity is setting up a repeat of the 2010’s when nine years were required to move from 2011’s 9% unemployment rate to a 3.5% unemployment rate in 2019.

Now, as was the case a decade ago, the same set of policy makers appear to hold sway. After the 2010 congressional election, the Tea Party, led by Mark Meadows, forced a series of budget compromises that drained the momentum from growth. The austerity induced policy changes were important contributors to a decade of disappointing income and productivity growth.

In 2011, although there is no immediate pressure on Treasury debt financing, policy makers, responding to Tea Party pressure, attempted to tackle the deficit aggressively.

While it is a worthy debating point that smaller government might be good for growth over the very long run, flash austerity would be a tremendous gamble in the current economic and public health environment. With interest rates near zero and with experience teaching that following shocks like the 2020 pandemic, hysteresis – persistence of initial conditions – will very likely severely limit employment gains.

Ironically, President Trump’s instincts are right. Despite the ineffectiveness of his proposed actions this weekend, more needs to be done. Now is not the time for false austerity.